Capital Market and Listing

Capital Market and Listing: -

Capital market is a market where buyers and sellers engage in trade of financial securities like bonds,

stocks, etc. The buying/selling is undertaken by participants such as individuals and institutions.

Capital markets help channelise surplus funds from savers to institutions which then invest them into

productive use. Generally, this market trades mostly in long-term securities.

Capital market consists of :

o Primary markets; and

o Primary markets; and

o Secondary markets.

o Secondary markets.

Primary markets deal with trade of new issues of stocks and other securities, whereas secondary market

deals with the exchange of existing or previously-issued securities. Another important division in the

capital market is made on the basis of the nature of security traded, i.e. stock market and bond market.

Listing : -

Going public and offering stock in an initial public offering represents a milestone for most privately

owned companies. Listing provides an exclusive privilege to securities in the stock exchange. Only

listed shares are quoted on the stock exchange. Stock exchange facilitates transparency in transactions

of listed securities in perfect equality and competitive conditions. Listing is beneficial to the

company, to the investor, and to the public at large. For trading in the stock market, a company has to

list its securities in the stock exchange. It means that the name of the company is registered in the

stock exchange. A company intending to have its securities listed on stock exchange has to comply with

the listing requirements prescribed by the stock exchange.

SEBI have launched numerous policy initiatives not only to strengthen the regulatory framework of the

Indian Capital market but also align the role of capital market with the international best practices

and more importantly to the investing and funding needs of the inspirational Indian population.

Broadly, the regulatory framework in India is in compliance with the OECD Principles, an international

benchmark worldwide. A step further in this direction has been envisioned through the policy measures

when SEBI notified the ‘Listing Obligations and Disclosure Requirements’ Regulations, 2015.

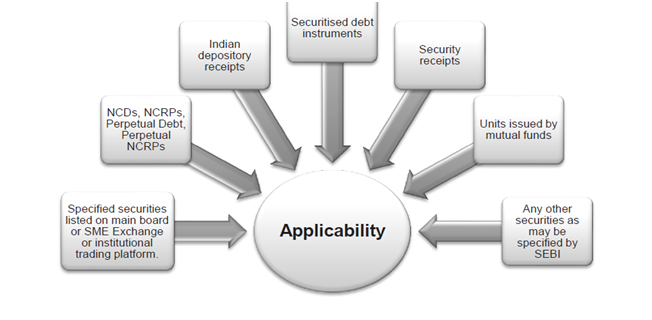

Applicability of the Regulations :

Meaning of Listed Entity :

According to SEBI Listing Regulations, 2015, “listed entity” means an entity which has listed, on a

recognized stock exchange(s), the designated securities issued by it or designated securities issued

under schemes managed by it, in accordance with the listing agreement entered into between the entity

and the recognised stock exchange(s).

As per the SEBI Listing Regulations, 2015, “designated securities” means any of the following

securities –

Specified Securities: Specified securities means ‘equity shares’

and ‘convertible securities’ as defined under clause (zj) of sub-regulation

Specified Securities: Specified securities means ‘equity shares’

and ‘convertible securities’ as defined under clause (zj) of sub-regulation  (1) of regulation 2 of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009.

(1) of regulation 2 of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009.

Non-Convertible Debt Securities: ‘Non-convertible debt securities’

which is ‘debt securities’ as defined under regulation 2(1)(e) of the

Non-Convertible Debt Securities: ‘Non-convertible debt securities’

which is ‘debt securities’ as defined under regulation 2(1)(e) of the  Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008.

Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008.

Non-Convertible Redeemable Preference Shares: ‘Non-convertible redeemable

preference shares shall have the same meaning as

Non-Convertible Redeemable Preference Shares: ‘Non-convertible redeemable

preference shares shall have the same meaning as  assigned to them in the SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013.

assigned to them in the SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013.

Perpetual Debt Instrument: ‘Perpetual debt instrument’ or

‘innovative perpetual debt instrument’ shall have the same meaning as

Perpetual Debt Instrument: ‘Perpetual debt instrument’ or

‘innovative perpetual debt instrument’ shall have the same meaning as  assigned to them in the SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013.

assigned to them in the SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013.

Perpetual Non-Cumulative Preference Shares: ‘Perpetual non-cumulative

preference share’ shall have the same meaning as

Perpetual Non-Cumulative Preference Shares: ‘Perpetual non-cumulative

preference share’ shall have the same meaning as  assigned to them in the SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013.

assigned to them in the SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013.

Indian Depository Receipts: ‘Indian depository receipts’ means

Indian depository receipts as defined in sub-section (48) of section 2 of

Indian Depository Receipts: ‘Indian depository receipts’ means

Indian depository receipts as defined in sub-section (48) of section 2 of  the Companies Act, 2013.

the Companies Act, 2013.

Securitized Debt Instruments: ‘Securitized debt instruments’ as defined

in the SEBI (Public Offer and Listing of Securitized Debt

Securitized Debt Instruments: ‘Securitized debt instruments’ as defined

in the SEBI (Public Offer and Listing of Securitized Debt  Instruments) Regulations, 2008.

Instruments) Regulations, 2008.

Units issued by mutual funds;

Units issued by mutual funds;

Any other securities as may be specified by SEBI.

Any other securities as may be specified by SEBI.

To know more, Please click here